- This report explains how stable non-oil economic growth anchors the 2026 GCC hiring outlook and workforce demand.

- We detail the specific engineering profiles needed to construct sovereign AI infrastructure in Saudi Arabia and the UAE.

- The text analyzes the transition of healthcare from a service to an industrial sector requiring genomic data specialists.

- We examine the market shift toward high-value legal and financial knowledge roles within regional shared services centers.

As the global economy advanced through the mid-2020s, the Gulf Cooperation Council (GCC) has emerged not merely as a consumer of global innovation but as a primary architect of a new industrial reality. By 2026, the labor markets of Saudi Arabia and the United Arab Emirates (UAE) are expected to transition from visionary planning phases to aggressive, tangible execution. This report posits that 2026 represents a critical inflection point: the year “sovereign capabilities” in artificial intelligence, genomic data, and specialized knowledge processes become the dominant drivers of human capital demand.

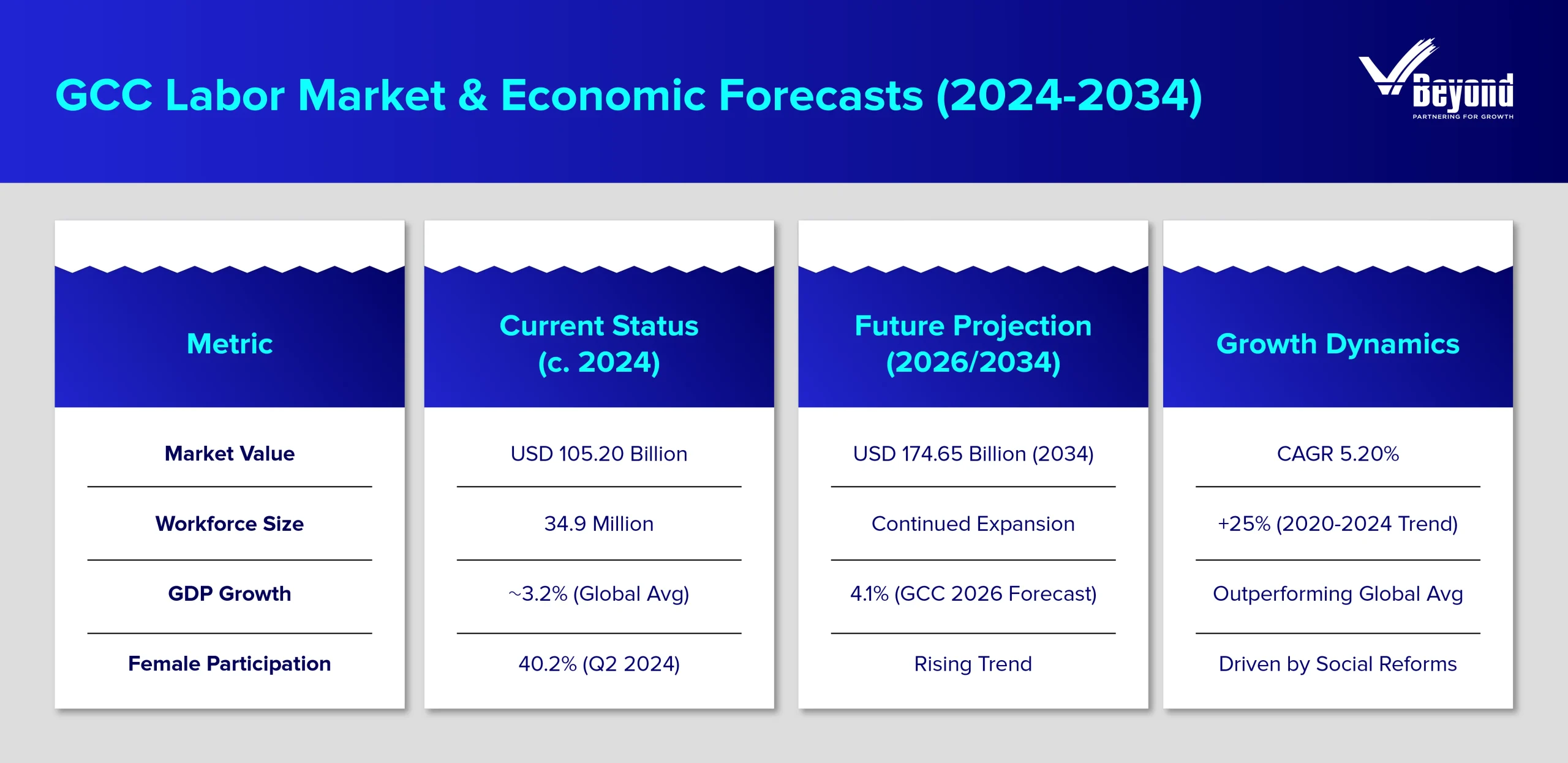

The statistical baseline for this transformation is robust. As per the Economic Times, the GCC labor market, valued at approximately USD 105.2 billion in 2030, is on a trajectory to reach USD 174.65 billion by 2034, expanding at a Compound Annual Growth Rate (CAGR) of 5.20%.

The demand signal for 2026 is not for generic labor; it is for a sophisticated cadre of professionals capable of operationalizing “AI Factories,” interpreting population-scale genomic datasets, and navigating one of the world’s most rapidly evolving regulatory landscapes.

The Macroeconomic Architecture of 2026

The hiring landscape of 2026 cannot be understood without first analyzing the macroeconomic architecture that supports it. Unlike previous economic cycles in the Gulf, which were inextricably linked to the volatility of crude oil markets, the 2026 outlook is characterized by a deliberate “decoupling” of labor demand from oil prices. This shift is driven by massive, state-led capital expenditure in non-oil sectors, creating a stable floor for employment growth even amidst global economic uncertainty.

The Non-Oil Growth Engine and GDP Projections

The International Monetary Fund (IMF) and regional economic bodies project a bullish outlook for 2026. The economies of the GCC countries are forecast to grow by 4.1% in 2026, a rate that significantly outpaces the projected global average. This growth is not uniform; it is heavily weighted toward the non-oil sectors of tourism, technology, finance, and industrial manufacturing which have become the primary engines of development.

In Saudi Arabia, non-oil GDP growth has already demonstrated resilience, posting rates of 4.5% in previous years, while the UAE has seen figures as high as 5.9%. This structural shift transforms the nature of labor demand. Where oil economies require a narrow band of petrochemical engineers and a large base of low-cost support labor, a diversified non-oil economy requires a “thick” labor market with depth in services, logistics, digital operations, and creative industries.

The Sovereign Multiplier Effect

A defining feature of the 2026 macroeconomic environment is the “Sovereign Multiplier.” Both Saudi Arabia and the UAE have adopted strategies of “technological sovereignty” and “health security.” They are no longer content to rent cloud capacity from foreign hyperscale’s or import generic pharmaceuticals. Instead, they are building domestic data centers, developing indigenous Large Language Models (LLMs), and establishing national genomic databases.

This strategic pivot creates a multiplier effect in hiring. For every core role created in a sovereign asset such as a systems architect at a national data center, multiple downstream roles are generated in cybersecurity, compliance, physical infrastructure maintenance, and specialized education. The labor market valuation growth of nearly USD 183.73 Billion by 2035 is largely attributable to this multiplier, as high-value roles generate significantly more economic activity than the low-skill roles they replace.

Demographics as Destiny: The Youth and Female Workforce

The demographic profile of the GCC in 2026 provides a fertile ground for this economic expansion. The region is characterized by a “youth bulge,” with a young, digitally native population that is increasingly entering the private sector. Furthermore, the labor market has witnessed a historic shift in female participation. By the second quarter of 2024, female participation in the GCC workforce had risen to 40.2%, up from 36.4% in 2019.

The Technology Renaissance: Sovereign AI and the “AI Factory”

By 2026, the GCC will likely have established itself as a global node for Artificial Intelligence (AI) compute power. The narrative of “tech hiring” has shifted from software application development to the heavy industrial engineering required to build and operate “AI Factories.” These are not merely data storage facilities; they are high-performance computing (HPC) clusters designed to manufacture intelligence in the form of AI tokens.

Saudi Arabia: Humain and the Infrastructure of Intelligence

In Saudi Arabia, the technological hiring landscape of 2026 is likely to be dominated by Humain, a Public Investment Fund (PIF) company that epitomizes the Kingdom’s sovereign AI ambitions. Humain’s roadmap is aggressive and physically expansive, creating a distinct hiring surge for specialized engineering talent.

1. The Physical Build: Riyadh and Dammam

By early 2026, Humain is scheduled to operationalize its first major data centers in Riyadh and Dammam. These facilities are launching with an initial capacity of 100 megawatts (MW) each, a massive power load that signals the deployment of high-density computing racks. This is merely Phase 1 of a broader vision to deploy 1.9 gigawatts (GW) of capacity by 2030.

The hiring implications of this physical build are profound. The “tech” jobs of 2026 in Dammam would be, in reality, advanced electrical and mechanical engineering roles.

- Power and Cooling Engineers: The deployment of 18,000 of Nvidia’s latest chips (including the Blackwell architecture) and AWS Trainium chips generate immense heat. Consequently, there is an urgent demand for engineers specialized in liquid cooling systems and high-voltage power distribution. These are not typical IT roles but rather specialized industrial facility roles.

- Hardware Systems Engineers: The installation and optimization of 150,000 AI accelerators in the planned “AI Zone” requires a workforce capable of managing hardware at a scale rarely seen outside of hyperscale’s like Google or Meta.

2 The “ALLAM” Model and Linguistic Sovereignty

Beyond hardware, Humain is developing ALLAM, a large language model dedicated to the Arabic language. This initiative drives a specific, high-value demand for Computational Linguists and Natural Language Processing (NLP) Engineers.

- Cultural Calibration: Unlike generic global models, ALLAM requires “tuning” to understand the diverse dialects and cultural nuances of the Gulf and the broader Arab world. This creates a niche market for AI ethicists and linguists who are fluent in both code and Arabic culture, a talent pool that is currently scarce and highly valued.

The UAE: Stargate and the “Intelligence Grid”

In the UAE, the hiring narrative is anchored by Stargate, a colossal supercomputing cluster developed by G42 in partnership with Khazna Data Centers. The project is positioning the UAE as a global exporter of AI capacity.

1. The Scale of Stargate

The first phase of Stargate, delivering 200MW of compute capacity, is slated for completion in the third quarter of 2026. The construction involves pouring over 100,000 cubic meters of concrete and utilizing steelworks weighing 1.5 times the Eiffel Tower.

- The “AI Factory” Shift: UAE officials explicitly describe these facilities as “AI Factories” designed to produce 60 trillion AI tokens. This conceptual shift changes the nature of operations. In 2026, the UAE is likely to be hiring Production Engineers for intelligence professionals responsible for optimizing “token throughput” and latency, just as a factory manager optimizes assembly line output.

2. The Talent Transition: From Construction to Operations

With over 5,000 workers currently on site constructing the facility, 2026 will likely mark the pivotal transition from civil construction to technical operations. The handover is expected to trigger a massive recruitment drive for:

- Network Reliability Engineers (NREs): To manage the “Intelligence Grid” that connects the UAE with Asia, Europe, and Africa.

- Sovereign Cloud Architects: Professionals capable of architecting systems that comply with strict data residency laws while leveraging the power of partners like OpenAI and Microsoft.

The Cybersecurity Imperative: Protecting the Crown Jewels

The concentration of sovereign data and massive compute power has elevated cybersecurity to a national security priority. By 2026, the demand for cybersecurity roles in the GCC is projected to outpace general IT hiring significantly.

- AI Security Specialists: As AI models become national assets, protecting them from “adversarial attacks” (attempts to manipulate or corrupt the model) becomes critical. The shortage of AI security expertise is identified as the fastest-growing skills gap for 2026.

- Governance, Risk, and Compliance (GRC): With the proliferation of data protection regulations in both KSA and UAE, the demand for GRC professionals is expected to grow by roughly 19%. These roles bridge the gap between legal requirements and technical implementation.

- Salary Premiums: Cybersecurity professionals in the region, particularly those in high-risk sectors like finance and energy, can expect salary growth of 12-15%, with Chief Information Security Officers (CISOs) commanding premium packages that rival CEO compensation in smaller firms.

Build your 2026 workforce today.

The Healthcare Industrial Complex: Capacity, Demographics, and Genomics

In 2026, healthcare in the GCC is likely to cease being viewed merely as a social service and to emerge as a heavy industrial sector. The “Healthcare Industrial Complex” is driven by a convergence of demographic pressure, government privatization mandates, and a leap into precision medicine.

The Expansion of Physical Capacity

The financial commitment to this sector is staggering. Current Healthcare Expenditure (CHE) in the GCC is forecast to reach USD 159 billion by 2029, growing at a robust CAGR of 7.8% from 2024 levels. The expenditure is translating directly into physical infrastructure, creating a linear relationship with hiring demand.

1. The Bed Capacity Challenge

To meet the needs of a growing population, the region is estimated to require 12,317 new hospital beds between 2024 and 2029.

- Saudi Arabia’s Dominance: The Kingdom accounts for the lion’s share of this demand, requiring over 8,500 new beds (69% of the regional total). This is driven by a CAGR in expenditure of 8.8%, the highest in the region.

- The Aging Demographic: A critical driver for 2026 is the aging population. The proportion of the GCC population over 50 years old is projected to increase from 12.7% in 2024 to 13.8% in 2029. The demographic shift necessitates a specific type of healthcare hiring: a move away from general pediatrics and obstetrics toward geriatric care, oncology, and chronic disease management.

2 Privatization and the PPP Model

A defining trend for 2026 is expected to be the privatization of healthcare delivery. Governments are actively shifting their role from provider to regulator, utilizing Public-Private Partnerships (PPPs) to expand capacity.

The Genomic Revolution and Precision Medicine

Beyond the “bricks and mortar” of hospitals, 2026 would mark the maturation of the GCC’s precision medicine initiatives. The region is investing heavily to map the Arab genome, creating a sophisticated market for bio-data talent.

1 Market Dynamics

The GCC genomics data analytics market, valued at USD 1.2 billion, is fueled by strategic national programs like the Saudi National Biotechnology Strategy and the UAE Genome Program. The UAE genomics market alone is expected to expand at a CAGR of 13.4%, reaching USD 236.5 million in 2026.

2 The Rise of the “Bio-Data” Workforce

This strategic focus is creating entirely new job families in the region, blending biology with data science.

- Genomic Data Analysts: As sequencing costs plummet and the volume of genetic data explodes, the bottleneck shifts to analysis. There is a critical shortage of analysts capable of interpreting terabytes of genetic data for clinical applications.

- Bioinformaticians: The integration of AI with genomics, a cornerstone of the UAE’s strategy, requires professionals who can bridge the gap between biological processes and algorithmic processing.

- Localization of Research: A key constraint is the need for localized knowledge. Genetic markers relevant to the Arab population often differ from global datasets. This is driving a need for researchers who are not just technically proficient but focused on regional genetic diversity.

The Knowledge Economy: From BPO to “Global Capability”

The Business Process Management (BPM) sector in the GCC is transforming. By 2026, the region is expected to move from the traditional “lift and shift” model of low-cost outsourcing toward high-value Knowledge Process Outsourcing (KPO) and Legal Process Outsourcing (LPO).

The Shift to High-Value Services (KPO)

The Saudi Arabian Business Process Outsourcing market is projected to grow from USD 3.35 billion in 2024 to USD 6.15 billion by 2032, at a CAGR of roughly 8%. However, the revenue composition is changing.

- Cloud and AI Integration: The “Cloud” segment of the BPO market is the fastest growing (8.44% CAGR). This indicates that BPM in 2026 is fundamentally going to be a digital service. Automation is replacing repetitive tasks, meaning the human agents remaining are handling complex, empathy-driven, or strategic interactions—effectively moving from BPO to KPO.

- Finance & Accounting: This remains the largest segment, but by 2026, it is likely to center on strategic financial planning and tax compliance rather than simple bookkeeping. The shift would be driven by the new corporate tax regimes in the UAE and electronic invoicing mandates in KSA.

Legal Process Outsourcing (LPO): The Regulation Driver

This is expected to be a specific and rapidly growing niche in 2026, particularly in Saudi Arabia.

- The Regulatory Tsunami: The Kingdom has witnessed the introduction of over 250 new regulations in recent years. The “regulatory density” has overwhelmed in-house legal teams, creating a surge in demand for external support.

- Demand Profile: LPO in 2026 would not just be document review; it would involve complex compliance management, contract drafting, and regulatory navigation. This is driving the hiring for paralegals, compliance officers, and contract managers who are bilingual and well-versed in Saudi law.

- Cost vs. Risk: With in-house legal team costs potentially exceeding SAR 1.2 million annually for mid-sized firms, companies are outsourcing to reduce costs while mitigating the high risk of non-compliance penalties.

The Rise of the GCC “Global Capability Center”

The term “GCC” in the corporate world increasingly refers to “Global Capability Centers”, or in-house offshore units of multinational corporations. By 2026, the Gulf region is expected to position itself as a host for these centers, particularly for regional HQs.

- Contractual Staffing: A major trend for 2026 is the rise of contractual and flexible staffing within these centers. It is projected that 25% of roles in Global Capability Centers will be contractual by 2026, up from 18% in 2024.

- Agility over Tenure: This shift allows companies to scale teams up and down based on project needs (e.g., a specific digital transformation phase) without the long-term liability of permanent headcount. It implies a fundamental change in the employer-employee relationship in the region, prioritizing “skills access” over long-term tenure.

Human Capital Dynamics: Compensation, Skills, and “The Talent War”

The competition for talent in 2026 would be fierce, driving significant changes in compensation structures and recruitment strategies. The “Talent War” would no longer be a cliché, but a quantifiable economic pressure, exacerbated by the global shortage of specialized AI and healthcare professionals.

Salary Forecasts and Inflationary Pressures

While the region remains attractive due to tax-free incomes, global competition for talent is pushing salaries upward.

- Forecasted Increases: In 2026, salaries in Saudi Arabia are projected to rise by 4.6%, outpacing the UAE, which is forecast to see increases of around 4.1%. This differential reflects the aggressive “pull” factors of the Saudi market as it accelerates Vision 2030 projects.

- The “10% Club“: The average figures hide the volatility at the top. Specialized roles in AI, digital transformation, and specialized finance (tax/audit) are expected to see salary hikes exceeding 10%.

- Sector Leaders: The Banking, Real Estate, and Industrial sectors are forecast to offer the most substantial hikes, underpinned by the massive project pipelines in both countries.

The “Skills-First” Recruitment Paradigm

By 2026, the recruitment paradigm in the GCC is likely to shift noticeably toward “skills-first” hiring.

- Verification of Capability: With the rapid obsolescence of technology, employers are prioritizing certifications and demonstrated capability (micro-credentials) over traditional university degrees. A candidate with a verified portfolio of AI model deployments is preferred over one with a generic computer science degree.

- Executive Transformation Leaders: The executive search market is focusing on “Transformation Officers”, or C-suite executives capable of managing the dual transition of digitization and nationalization. There is a specific demand for CFOs and Finance Directors who can navigate the new corporate tax landscapes in the UAE and the complex Zakat/tax environment in KSA.

Retention Strategies: The Return of the Family Package

To combat high turnover rates, attrition in tech/data roles could reach 25-35% in 2026. Companies are reversing the trend of “unbundling” benefits.

- Holistic Compensation: There is a resurgence of “family packages” including generous schooling allowances and enhanced medical coverage. This reinstatement is crucial for attracting senior expatriate talent who view the region as a long-term family destination rather than a short-term hardship post.

- Wellbeing as Currency: Employee wellbeing and “work-life balance” are cited as key retention drivers, with 80% of employees in the region willing to switch jobs for better pay or conditions.

Strategic Conclusion: The 2026 Imperative

The GCC labor market in 2026 is set to be defined by high stakes and high rewards. The region has successfully moved past the initial phases of its grand economic visions and is now deep in the implementation phase. This transition demands a workforce that is not only larger but fundamentally different in its capabilities.

In conclusion, success in the GCC hiring market in 2026 will likely depend on the ability to navigate this complex landscape. It requires looking beyond headcount numbers to understand the deep, structural shifts in what work is being done, where it is being hosted, and who possesses the sovereign skills to execute it. The region is building a future where data is the new oil, and the workforce that mines, refines, and protects that data is the most valuable asset of all.

FAQs

1. What is the projected salary increase in the GCC for 2026?

Forecasts indicate an average salary increase of 4.6% in Saudi Arabia and approximately 4.1% in the UAE. However, specialized roles in AI, finance, and GCC digital transformation may see double-digit increases exceeding 10% due to talent scarcity in the region.

2. Which sectors will see the highest hiring demand in 2026?

The highest demand will come from Technology (specifically AI engineering and cybersecurity), Healthcare hiring (driven by new infrastructure and genomics), and Knowledge Process Outsourcing (Finance and Legal services). Non-oil sectors are the primary engines of this growth in GCC hiring.

3. How is the BPO sector changing in the region?

The sector is shifting from traditional low-cost BPO to high-value Knowledge Process Outsourcing (KPO). Demand is rising for specialized skills in finance, tax compliance, and legal services rather than simple transactional support, driven by automation and regulatory changes in GCC shared services.

4. What are the key healthcare hiring trends?

Beyond doctors and nurses, there is a surge in demand for Genomic Data Analysts and bio-data specialists to support precision medicine initiatives. Additionally, the aging population is driving a specific need for geriatric care specialists and chronic disease management professionals in Saudi Arabia hiring and UAE hiring.