- Pay Transparency 2.0 mandates precise salary ranges or fixed pay, plus standardized disclosure of benefits and full compensation.

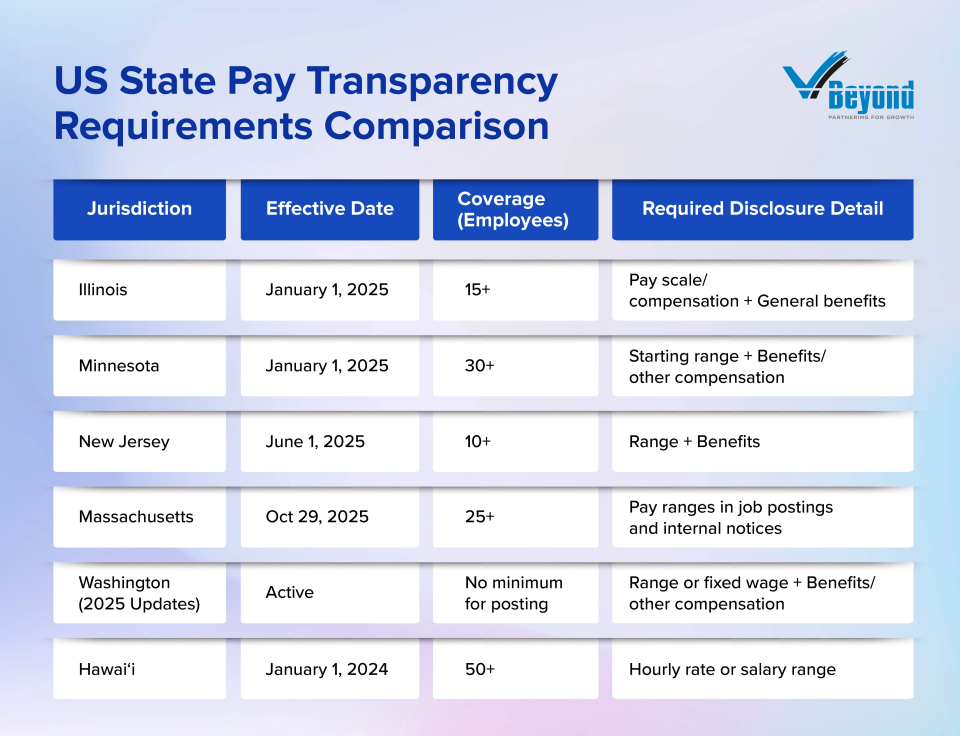

- Major U.S. laws in Illinois, Minnesota, New Jersey, and Massachusetts take effect by the end of 2025, defining national compliance standards.

- New quantitative rules, like New Jersey’s 60% limit, require organizations to impose rigorous controls on pay range design.

- Prepare for simultaneous U.S. state requirements, Canadian rules, and the EU Directive transposition by June 2026.

The current regulatory movement surrounding compensation disclosure marks a fundamental evolution from simple salary disclosure to a prescriptive framework defined as Pay Transparency 2.0. This new compliance paradigm mandates that organizations publish precise salary ranges or a fixed pay amount job postings in job advertisements, coupled with standardized disclosure of benefits and other required compensation details. This is no longer merely a human resources compliance topic; it requires strategic governance over compensation methodology and information technology systems.

What changed in 2024 and 2025?

In 2024,Hawaii enacted rules requiring salary range disclosure for employers with 50 or more employees, effective January 1, 2025. Although the law does not specify that the employees must be located in Hawaii, the implication is that large organizations nationwide are potentially covered. Concurrently, Colorado’s revised rules and guidance, known as INFO 9A, took effect January 1, 2025, confirming the requirement to disclose compensation and benefits in job postings and clarifying complex internal notice obligations.

2025 Milestones: Defining Pay Transparency 2.0

By the end of year 2025 will see compliance obligations solidify across major U.S. labor markets:

- Illinois (January 1, 2025): Postings must show the pay scale or compensation and a general description of benefits for employers with 15 or more employees. The law also includes provisions for third-party liability and internal notification requirements for promotional opportunities.

- Minnesota (January 1, 2025): This state requires a starting salary range plus a general description of benefits and other compensation. Crucially, the statute bans open-ended ranges and requires listing a fixed rate if no range is offered.

- New Jersey (June 1, 2025): The law took effect, with rules establishing a specific mechanism for controlling range quality by capping the range width at 60 percent of the minimum. This quantitative limit requires organizations to narrow their internal compensation bands significantly before posting.

- Vermont (July 1, 2025): Requires a good faith minimum and maximum compensation in advertisements for employers with five or more employees, applying even to remote roles tied to a Vermont office.

- Washington (July 27, 2025, updates): Amendments clarify that when compensation is fixed, a single fixed pay amount job postings is permitted rather than a range. These updates also adjust damages and procedures, including a temporary cure period for noncompliance.

- Massachusetts (Oct 29, 2025): Requires salary ranges in job postings for employers with 25 or more employees, extending the requirement to disclosure during promotions or transfers.

International Deadlines

Outside the US, proactive regulatory steps continue:

- British Columbia (Ongoing): The province continues to require expected pay or a range in publicly advertised postings, issuing guidance that invalidates wording such as “up to 30 dollars”.

- Ontario (Confirmed January 1, 2026): A new rule will mandate compensation disclosure with a strict $50,000 maximum spread on posted ranges in most cases.

- EU Directive (Deadline June 7, 2026): Member states must transpose the Directive, which requires giving pay information in the vacancy notice or before the first interview. The legislative actions in 2025 across key jurisdictions signal the shift from regulatory ambiguity to definite, enforceable standards regarding the structure and equity of advertised compensation.

Definitions that affect day-to-day posting

Regulatory compliance relies heavily on precise definitions of what constitutes a valid pay advertisement and which employers are covered. Organizations must operationalize these definitions to manage Job posting requirements effectively.

“Salary range” vs “fixed amount” in the ad

The requirement for salary range disclosure has been clarified to accommodate roles where compensation is non-negotiable. Minnesota’s statute codifies both options, requiring disclosure of a fixed pay rate if no range is offered, and explicitly banning open-ended ranges that lack a defined floor and ceiling. Similarly, Washington’s 2025 amendments confirm the permissibility of listing a single fixed wage when that is the sole compensation offered. This dual approach clarifies the compliance path for positions with predetermined pay scales, allowing for accurate fixed pay amount job postings.

Benefits and other compensation

Compliance systems must move beyond base salary and address the entire compensation package. Illinois and Minnesota require a general description of benefits and other compensation in the posting. New Jersey postings must also include benefits information. Standardizing descriptions for health plans, retirement benefits, and material bonuses for automated insertion into posting templates is therefore mandatory.

Which postings are covered: Extraterritorial Reach

One of the most complex issues is the jurisdictional scope. Coverage often extends beyond the physical location of the job, making compliance a workflow and organizational design challenge rather than a purely geographical one. Illinois coverage, for example, extends to roles performed partially in the state or reporting to an Illinois supervisor or site. New Jersey’s rules apply the law to employers with 10 or more employees who either do business or take applications in New Jersey, potentially covering positions located entirely outside the state. Furthermore, Illinois guidance holds employers liable for Job Posting Salary Range omissions by third party recruiters they engage. When a remote role reports to a supervisor in a stringent state, that state’s Pay Transparency Laws must dictate the posting content, requiring recruitment platforms to check jurisdictional triggers like supervisor location before publishing.

U.S. spotlight: State-by-state posting rules that matter now

The complexity of U.S. pay transparency regulations is magnified by varying employee thresholds, disclosure requirements, and enforcement mechanisms across states. A robust compliance strategy requires detailed recognition of these differences.

1. Illinois

The Pay Transparency amendment to the Illinois Equal Pay Act of 2003 applies to employers with 15 or more employees. If an employer chooses to make an external job posting, they must include the pay scale or compensation and a general description of benefits. The requirement applies when work is performed in part in Illinois or is linked to an Illinois supervisor or site. Practical duties include notifying all current employees of publicly advertised promotional opportunities within 14 days. A confidential complaint channel exists, and the state allows early opportunities to correct initial violations before penalties escalate.

2. Minnesota

Effective January 1, 2025, Minnesota’s law covers most employers with 30 or more employees at one or more Minnesota sites. Postings must include the starting salary range based on the employer’s good faith estimate, plus a general description of all benefits and other compensation. If a range is not offered, a fixed pay rate must be listed; open-ended ranges are explicitly barred.

3. New Jersey

The law is effective June 1, 2025, though detailed regulations are already providing critical guidance. The rules suggest broad coverage for employers with 10 or more employees who either do business or take applications in NJ. The range design rule is arguably the most prescriptive in the US, limiting the maximum spread between the minimum and maximum pay range to 60 percent of the minimum. This quantitative control measure forces rigorous justification for the low and high ends of a compensation band before the Job Posting Salary Range is published. The scope also raises the possibility of covering roles located outside the state if the employer meets the minimum employee count and operational criteria in New Jersey.

4. Massachusetts

Starting October 29, 2025, employers with 25 or more employees must adhere to disclosure requirements. The state requires pay ranges in external job postings and also mandates internal disclosure: ranges must be provided to existing employees who receive a promotion or transfer to a new position, and upon request from employees or applicants.

5. Vermont

Effective July 1, 2025, the law applies to employers with five or more employees and at least one employee in Vermont. The posting must include compensation or a range of compensation determined in good faith, applying to remote roles tied to a Vermont office. An important nuance is that the law explicitly permits deviation from the posted range based on circumstances such as an applicant’s qualifications or labor market factors.

6. Washington

Washington requires the wage scale or salary range plus a general description of benefits and other compensation. Amendments effective July 27, 2025 clarify that when compensation is fixed, listing a single fixed wage is permitted instead of a range. Damages for violations typically fall between $100 and $5,000 per violation, plus fees, and the amendments establish a five-business-day cure period for noncompliance through July 27, 2027.

7. Colorado

Colorado’s Equal Pay for Equal Work Act mandates disclosure of compensation and benefits in all job postings and notices, alongside strict internal notice rules for all job opportunities. The 2024 guidance (INFO 9A) introduces subtle yet important exceptions to the internal notice rule for career advancement. These include “Career progression” (automatic promotion based on objective metrics) and “Career development” (non-competitive promotion reflecting work already performed). This distinction provides organizational design leaders a mechanism to manage internal salary transparency requirements while rewarding high performers without creating a competitive external opportunity.

8.Hawaii

Effective January 1, 2024, Hawaii’s law applies to employers with 50 or more employees, requiring the posting of the hourly rate or salary range that reasonably reflects expected pay. FAQs confirm that the 50-employee threshold does not require those employees to be based in Hawaii.

Canada spotlight: British Columbia and Ontario

Canadian jurisdictions demonstrate different approaches to controlling the quality of Job Posting Salary Range information: one emphasizing qualitative clarity, the other imposing definitive quantitative limits. This difference means organizations must use adaptive posting systems based on regional regulatory styles.

British Columbia

The province requires the expected wage or salary or a range in any publicly advertised posting. Official guidance focuses on ensuring the disclosed information is clear and defined. This guidance specifically states that vague wording such as “up to 30 dollars” or “20 dollars and up” does not meet the requirement because it fails to provide a defined floor and ceiling for the expected pay. This is a regulatory preference for qualitative control over pay information, ensuring clarity for applicants. Currently, British Columbia has not set a numeric cap on the spread of the advertised range.

Ontario

Effective January 1, 2026, for employers with 25 or more employees, Ontario introduces a quantitative rule for pay disclosure. If a range of expected compensation is used in a publicly advertised job posting, the spread between the minimum and maximum compensation cannot exceed $50,000. This rule enforces a highly disciplined approach to compensation structuring for roles falling under the high-salary exemption.

The high-salary exemption applies where the expected annual compensation, or the top of the expected range, exceeds $200,000. For all other roles, the $50,000 maximum spread means that internal pay bands must be significantly narrowed before the job is advertised, directly influencing internal pay equity assessment processes. The Ontario requirement represents an advanced application of pay transparency principles by strictly limiting the administrative ease of broad, undefined compensation bands.

European Union and the United Kingdom

The European landscape provides a contrast between future legislative certainty dictated by the EU Directive and the current market-driven practice observed in the UK. This highlights the importance of managing global pay transparency rules.

1. European Union

The deadline for member states to transpose the EU Pay Transparency Directive (Directive (EU) 2023/970) into national law is June 7, 2026. The Directive requires employers to give applicants information about the starting pay level or range either in the vacancy notice or before the first job interview.

This flexibility introduces strategic complexity for multinational organizations, as member states are choosing different transposition mechanisms. For instance, the draft Irish legislation may require salary disclosure in the job advertisement itself, while the draft Dutch legislation allows employers to inform candidates only before the interview. Organizations must plan for country-by-country variation and monitor official national drafts for potential stricter rules. A common strategic decision point is whether to default to the strictest in-advert requirement for all pan-European postings. Adopting an “earliest point of disclosure” policy reduces complexity and minimizes the risk of noncompliance in jurisdictions that choose the stricter implementation path.

2. United Kingdom

The UK does not have a national statute mandating salary disclosure in job postings as of 2025. However, market practice dictates a strong degree of openness. Independent data shows that the UK leads major European peers in pay transparency, with roughly 71 percent of job postings including pay details, a significant rise from 48 percent in 2019. While not legally compelled, this high level of market transparency creates a competitive expectation for talent acquisition. Organizations must view pay openness as essential for attracting and retaining talent, regardless of legal statutes.

Range design rules that are now explicit in some places

The defining characteristic of Pay Transparency 2.0 is the regulatory imposition of explicit rules concerning the structure of the Job Posting Salary Range. Compliance is no longer achieved merely by providing a number, but by ensuring that number adheres to technical limits.

No Open-Ended Ranges

A fundamental shift requires compensation figures to have a clearly defined floor and ceiling. Minnesota expressly bars ranges without both a minimum and a maximum. British Columbia’s guidance confirms that qualitative terms such as “up to” and “and up” are invalid. New Jersey’s rules strictly prohibit open-ended ranges. This commitment to definitive salary disclosure strengthens the accuracy of applicant expectations.

Mandated Width Limits

Quantitative constraints are highly significant because they directly influence internal compensation equity controls. New Jersey proposes a strict width limit, ensuring the range spread cannot exceed 60 percent of the minimum salary. Ontario imposes a maximum spread of $50,000, with an exception for highly compensated roles. These narrow ranges require organizations to pre-define the criteria for paying a new hire at the minimum versus the maximum before posting the job, significantly strengthening compensation governance.

Use a Fixed Amount When That Is the Only Offer

The new rules acknowledge non-negotiable compensation models. Washington’s 2025 amendments confirm that when compensation is fixed, a single fixed rate may be listed. Minnesota’s statute provides a similar allowance. This validates a compliant pathway for roles with predetermined, non-variable pay structures.

Add Benefits and Other Compensation Where Required

The expansion of disclosure to include the total compensation package is standardized in several key states. Illinois, Minnesota, and New Jersey postings must include a general description of benefits and other compensation. Centralizing this benefits text is necessary to mitigate localized error risk across different job postings.

Handle Remote and Cross-Border Postings Carefully

The extension of jurisdictional reach to remote work models complicates systems design. Illinois coverage is triggered by work performed partially in the state or reporting into an Illinois supervisor or site. New Jersey’s guidance suggests broad scope, potentially applying to postings for roles outside NJ if the employer meets the criteria for operating in the state. Organizations must build compliance systems capable of applying rules based on non-geographic criteria such as reporting structure.

Penalties and claims exposure snapshot

Exposure under modern Pay Transparency Laws involves both financial penalties and systemic operational risks. Regulatory bodies are clarifying how enforcement occurs, which allows organizations to better calculate aggregate risk.

In Washington, statutory damages are quantified, typically ranging from $100 to $5,000 per violation, in addition to fees, and enforcement occurs through civil actions and administrative mechanisms. The regulatory preference in Washington is to allow administrative correction over immediate litigation for minor technical violations, evidenced by the five-business-day cure period available through July 27, 2027. This cure period necessitates establishing a robust, real-time auditing and rapid response process to amend non-compliant postings quickly.

In Illinois, the Department of Labor manages complaint intake, which includes anonymous filings, offering cure periods for early violations before penalties escalate. Colorado’s enforcement rules (INFO 9A) define violations based on posting and internal notice duties, with the Division empowered to order changes to practices and levy fines. In Massachusetts, state guidance discusses enforcement and fines. The trend toward quantified statutory damages allows for more predictable risk calculation, but the operational risk remains high. A single, inaccurate posting template replicated across multiple states can rapidly multiply aggregated financial exposure, making centralized template control critical.

Conclusion: What to do next, by quarter

Managing the pick-up in global pay transparency rules requires the adoption of a rigorous, centralized compliance schedule focused on system readiness and governance. The convergence of strict design rules and high-volume posting creates immediate operational risk.

It is recommended that organizations establish a quarterly posting review cadence coordinated between Legal, Human Resources, and IT teams. Key controls should include:

- Immediate update of master posting templates to integrate standardized benefits description text, which is increasingly mandated across U.S. jurisdictions.

- Conducting targeted legal reviews for priority jurisdictions (New Jersey, Minnesota, Illinois, Massachusetts) to confirm adherence to new range design constraints, such as the New Jersey 60 percent rule.

- Implementing periodic automated checks against official regulatory pages to monitor the final publication of rules, particularly for the EU Directive (June 7, 2026 transposition deadline) and Ontario (January 1, 2026).

Proactive system calibration now, focusing on key milestones—Massachusetts (October 29, 2025), New Jersey (June 1, 2025), Minnesota and Illinois (January 1, 2025), and Vermont (July 1, 2025) —mitigates the risk of systemic noncompliance and aggregated financial exposure. Centralized control of all Job Posting Salary Range templates is the most immediate operational requirement to maintain compliance in this rapidly evolving regulatory landscape of pay transparency.

FAQs

1. What is Pay Transparency 2.0 in 2025?

Pay Transparency 2.0 is the shift to prescriptive rules requiring precise salary ranges or fixed pay amount job postings in job advertisements. It also mandates standardized disclosure of benefits and other compensation details, focusing regulatory attention on the structure and equity of the advertised compensation.

2. Which states require salary ranges in job postings in 2025?

Major U.S. states activating salary range disclosure in 2025 include Illinois (January 1), Minnesota (January 1), New Jersey (June 1, subject to proposed 60% range limit), Vermont (July 1), and Massachusetts (Oct 29).

3. How does the EU Pay Transparency Directive affect global hiring?

The Directive, with a June 7, 2026 deadline, requires employers to provide starting pay information in the job notice or before the first interview. It necessitates planning for country-by-country variation in compliance, as member states choose different implementation paths.

4. Do benefits and other compensation need to be disclosed in job postings?

Yes, in several key U.S. jurisdictions. Illinois, Minnesota, and New Jersey require a general description of benefits and other compensation alongside the salary range. This expands the disclosure requirement to the total compensation package.

5. Is there a penalty for not posting a salary range?

Yes, enforcement and penalties vary by jurisdiction. Washington’s statutory damages, for instance, range from $100 to $5,000 per violation. Illinois and Colorado utilize complaint channels, cure periods for early violations, and escalating fines to ensure posting compliance.